Organizing Your Taxes - Smart Ways To Save Money

This post may contain affiliate links. This means if you click on the link and purchase

the item, I will receive an affiliate commission. More here: Disclaimer & Privacy Policy

Taxes...yuck! Here are 5 tips on organizing your taxes to get them done quickly and painlessly. One of the easiest ways to save money and frustration is to be organized...

No one likes doing taxes (or paying them for that matter), but getting them done with as little hassle as possible is fantastic and very satisfying!

Below you'll find 5 easy tips for simplifying the tax preparation process as well as some products that can help. Happy reading!

5 Tips For Organizing Your Taxes

1. Know your stuff.

It is vital to know what kind of information you should be collecting and keeping track of in order to do your taxes. Talk to your accountant, do some research or read best-selling tax books about your specific situation (i.e. own a small business or pay student loan debt), so that you know exactly what information you need to gather throughout the year. That brings us to the next tip...

2. Keep a running list.

There are all kinds of documents that you could need for organizing your taxes, so keep a running list of the records you should gather every year.

My list is a Microsoft Word document that I can easily edit if necessary. Every year when I'm organizing my taxes, I refer to the list and gather exactly what my accountant needs. He absolutely loves it, and it really minimizes how long it takes for him to do my taxes (which saves me money). It's a win-win!

My list looks like this:

Documents to Gather for Tax Returns

- Income (consulting services, referral fees, website ads, affiliate programs, book sales, husband's income)

- Expenses (totals, totals by category, student load interest, husband's expenses)

- Mileage (business, personal, husband's, total)

- Interest (bank accounts)

- W-9

- 1099

- End of year financial statements & tax forms

- Quarterly tax payments (copies of checks & pay stubs)

- IRA contribution records

- Donations (receipts, confirmation letters, calculate value of donated goods)

- Any other tax forms received in the mail

3. Track daily expenses.

This tip for organizing your taxes ties into one of the fundamentals of staying organized - do a little bit every day. It is so overwhelming to look at a huge pile of receipts from the year knowing it's going to take a while to add them up. Avoid that altogether by keeping track of expenses daily.

First, make sure you know which expenses you need to keep track of (like it says above). On a regular basis (I do it daily but do it every few days or weekly if that works for you), enter your expenses into a program like QuickBooks or scan receipts using a receipt scanner to create a digital filing system. Then at tax time, you can quickly create a report of totals for each category of expenses.

Spending literally a minute or 2 every day to enter my expenses saves me the hours it could take to total the whole year up at once. This is also one of the smart ways to save money if you pay someone to do this. Either way, it's so worth it!

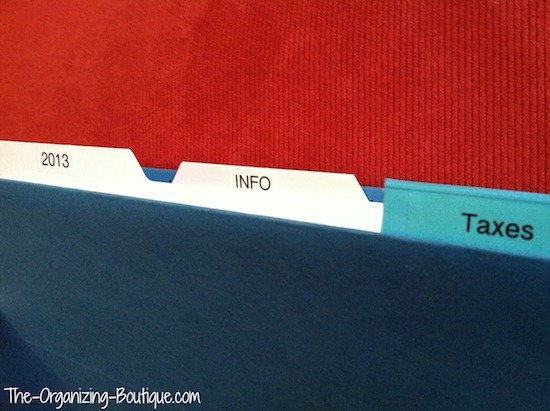

4. Keep at least 2 tax file folders.

One of my simplest tips for organizing your taxes is to create a home for your tax documents, so that you have a place to quickly put them when they come in the mail or what have you.This also means you can just as easily retrieve these documents at tax time.

At a minimum, I would suggest that you have 2 tax folders - one for the year and one for tax info that pertains to every year.

The tax folder for the year is where you put all tax-related documents for the current year like charitable contribution letters. The tax info folder contains papers that relate to every year like the running list I talked about above and copies of a W-9. See my tax folders below!

If your tax folders are overflowing, then consider creating a few more separate files. For example if you donate a lot, then you might want to create a folder just for the year's charitable contributions where you organize receipts and confirmation letters from donations. If you run a small business, then you might want to have a separate folder for collecting expense receipts for the year.

5. Archive completed tax returns.

Once you get your taxes done, keep the return and all supporting documents together (ideally in a fire-proof file cabinet). This way you can easily pitch these things when they are no longer necessary (generally 7 years) or quickly refer to something should you need to.

Facebook Comments